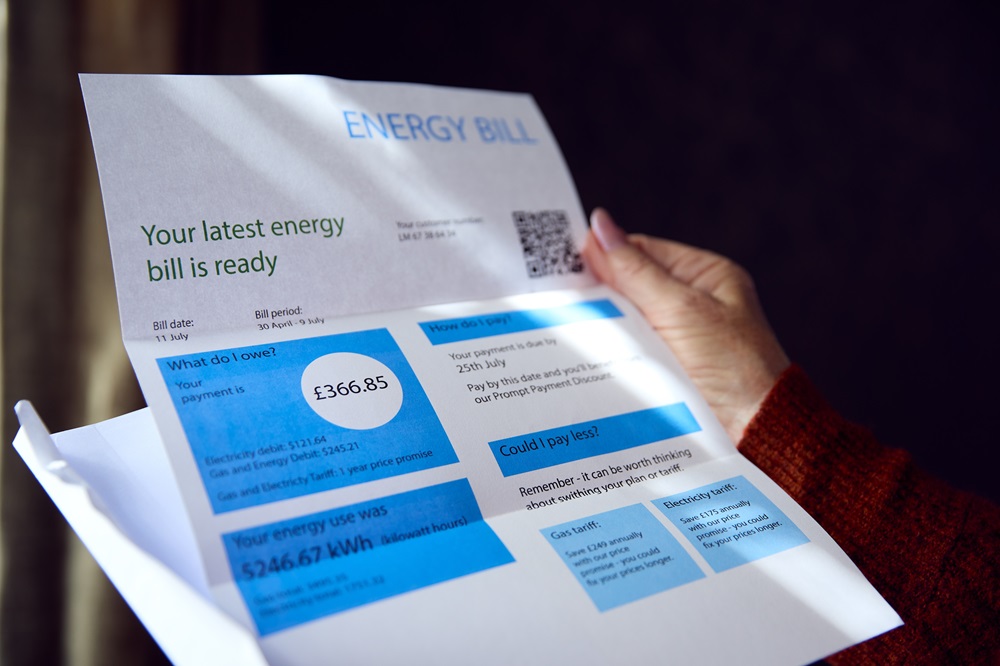

How can I lower my energy bills and what help is there for me?

Consumers face an increase in energy costs from October as Ofgem’s price cap is set to rise.

Ofgem, the UK regulator for gas and electricity markets, announced that they plan to raise the cap from its current place at £1,568 a year for the typical household, to a new high of £1,717. A rise of nearly £150 for the average family living across Wales, Scotland and England.

The price cap is the maximum that energy suppliers can charge consumers, so some consumers may be hit by this change more than others. It is important to note, though, the price cap isn’t a limit to your energy bill, it’s simply a limit to the amount that can be charged each kilowatt hour (kWh) of energy you use, meaning your bill could still rise higher if your usage does the same.

Why

The price cap typically rises for many reasons, though Ofgem has said that this rise specifically is based on heightened geopolitical tensions and extreme weather events driving up prices in the international energy market.

Ofgem’s chief executive, Jonathan Brearly, said: “international gas prices – the gas that we buy to heat our homes and to make sure we have the electricity we need – has gone up, and that’s feeding through to our bills”.

“Ultimately, while we are dependent on gas, we will be in this situation where prices go up and down,” he told Sky News.

Shop around

Customers are often encouraged to ‘shop around’ to try and get a better deal on their energy tariff, something frequently suggested by the likes of Martin Lewis, founder of money saving expert and a plethora of other sites and tools designed to help consumers.

Jonathan Brearly suggest the same, saying: “For the first time in a long time, we are seeing some good value deals emerge, I’d encourage people to shop around and consider fixing if there is a tariff that’s right for you – there are options available that could save you money, while also offering the security of a rate that won’t change for a fixed period.”

Martin Lewis cautions people: “Can and should save by switching – The cheapest year-long fixes on the market right now are about 7% less than the new October price cap, but they might not be around long”

Emily Seymour, energy editor for Which?, the UK brand aimed at keeping consumers informed, said: “Unfortunately, there’s no ‘one size fits all’ approach when it comes to fixing an energy deal as it will all depend on your individual circumstances.

“You should compare what your monthly payments would be on a fixed deal with what you’d expect them to be if you remain with the price-capped variable tariff to see what the best option is for you.

“As a rule of thumb, we’d recommend looking for deals around the price of the current price cap, not longer than 12 months and without significant exit fees.”

Support

Ofgem has urged people to take full advantage of any state benefits they may be entitled to, as this can help ease the burden of rising energy costs, as well as the broader cost of living.

For example, around 1.4 million pensioners are currently receiving pension credit, but Government estimates suggest that up to 880,000 additional households could be eligible for this support, which is designed for those on a low income.

Those who qualify for pension credit are also eligible for the Winter Fuel Payment, which is worth up to £300 to help with energy bills. Previously, this payment was available to everyone over the state pension age. However, changes introduced by the new Government mean that around 10 million pensioners are set to miss out this year.

Help

For anyone concerned about paying their energy bills, it’s recommended that they contact their energy supplier as soon as possible. Energy companies are obligated to work with customers to create a payment plan that’s affordable, potentially offering more flexibility in how and when payments are made.

Suppliers must consider the customer’s income, outgoings, personal circumstances, and any outstanding debts, while also estimating future energy use. Regular meter readings can help build a more accurate picture of usage and ensure bills reflect actual consumption.

Richard Lane, from the debt charity StepChange, has expressed concern that the upcoming rise in the price cap may push struggling households deeper into debt. He called on the Government to implement more targeted assistance for those most in need across the UK.

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

‘How can I lower my energy bills’ – Turn your central heating down. I find it ridiculous the amount of people who have the heating at 21c (or more) – 18c is fine unless you have a medical condition. 18c means wear a jumper indoors. Winter is the season for jumpers. And with the lower temperatures you save heaps of money. Each degree down saves you about £100 a year for the average house. So, wearing a jumper and turning your heating down will save you £300…

You can also call the Welsh Government’s Nest helpline for free advice, signposting to support and access to free energy saving improvements (like insulation, solar panels etc) for eligible households. The Development Bank of Wales are launching a similar offer soon, open to all households, that offers 0% loans for energy saving measures