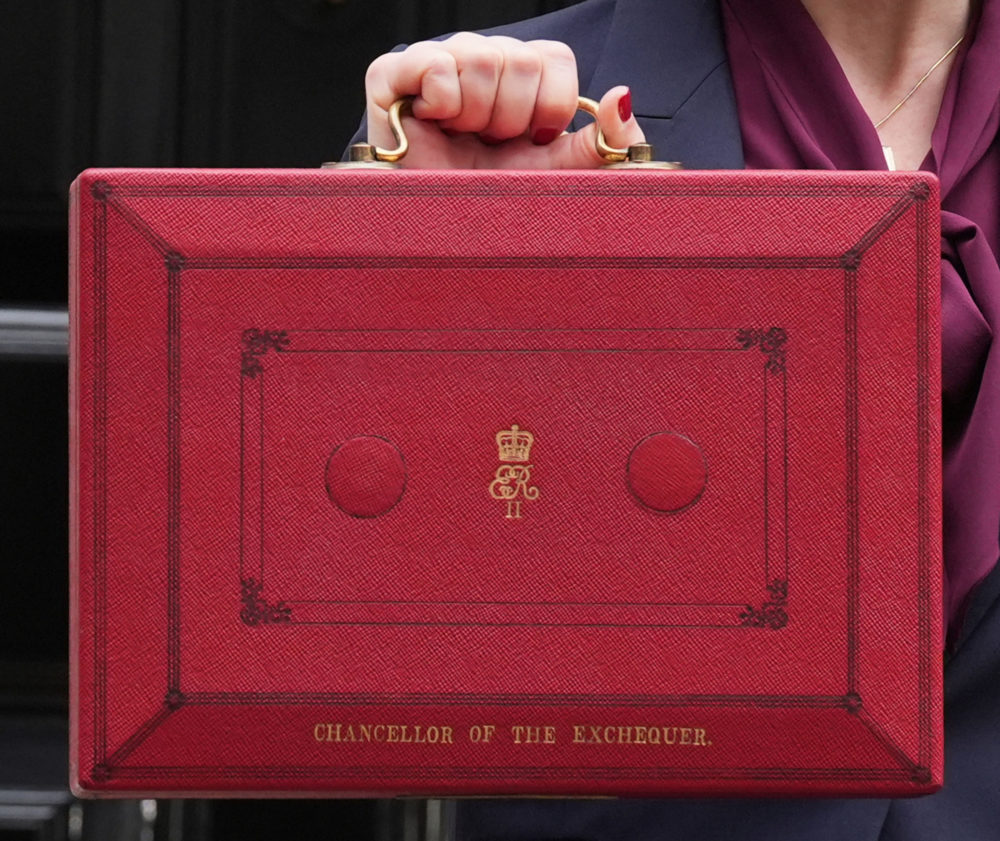

Lower pay rises likely due to Budget tax increases, Rachel Reeves admits

Tax rises in the Budget are likely to hit workers in the pocket with lower pay rises, Rachel Reeves has admitted.

The Chancellor acknowledged her decision to raise national insurance contributions (NIC) for employers could impact wage growth for private sector workers, or companies will have to absorb costs.

Economics experts branded the increase a “tax on working people” which will “definitely” show up in their wages.

Ms Reeves also said she did not want to repeat the £40 billion tax rises she implemented in her first Budget “ever again”.

Tax burden

Choices made by the Chancellor will see the overall tax burden reach a record 38.3% of gross domestic product (GDP) in 2027-28, the highest since 1948.

Despite Labour’s promises to protect “working people”, a £25.7 billion increase in national insurance contributions paid by employers is likely to reduce wages and lead to job losses, something Ms Reeves herself admitted.

Asked about the consequences of the move, the Chancellor told BBC Breakfast: “I said that it will have consequences.

“It will mean that businesses will have to absorb some of this through profits and it is likely to mean that wage increases might be slightly less than they otherwise would have been.”

Squeeze

The Office for Budget Responsibility (OBR) forecasts that by 2026-27, some 76% of the total cost of the NICs increase is passed on through lower real wages – a combination of a squeeze on pay rises and increased prices.

The measure could also lead to the equivalent of around 50,000 average-hour jobs being lost, the watchdog said.

Ms Reeves later suggested the tax rise was not an easy choice, telling BBC Radio 4’s Today programme: “Look, what alternative was there? We had a £22 billion black hole in the public finances.”

The Chancellor insisted ministers had “protected the smallest businesses” from the tax hike, and had stood firm on its promise not to raise the key taxes on “working people” – national insurance, income tax and VAT.

Ms Reeves plans to pour more public cash into schools, hospitals, transport and housing – and will change the way government debt is measured to allow her greater borrowing flexibility.

Mismanagement

“This Budget was to wipe the slate clean after the mismanagement and the cover-up of the previous government,” Ms Reeves told Times Radio.

She added: “I had to make big choices. I don’t want to repeat a Budget like this ever again, but it was necessary to get our public finances and our public services on a stable trajectory.”

The Chancellor was also unable to say whether her pledge at the Budget to raise income tax thresholds after 2028 was guaranteed.

“I’m not going to be able to write future budgets,” she said.

Shadow chancellor Jeremy Hunt meanwhile said his counterpart had angered many people, who felt she had not lived up to the spirit of Labour’s manifesto promises not to increase taxes for working people.

“Many people thought this was a new Labour prospectus, not a traditional tax-and-spend prospectus, and they have woken up to a Chancellor who has given us the biggest tax-raising Budget in history,” Mr Hunt told BBC Breakfast.

He later told Sky News: “However much Labour tries to say that their tax rises won’t hurt ordinary families, the OBR and the Institute for Fiscal Studies say it’s going to mean lower pay, lower living standards, higher inflation, higher mortgages – so it is a very sad day for ordinary families.”

James Smith, research director at the Resolution Foundation economic think tank, said the employers national insurance tax hike “will definitely show up in wages”.

He added: “This is definitely a tax on working people, let’s be very clear about that.

“Even if it doesn’t show up in pay packets from day one, it will eventually feed through to lower wages.”

GDP

The OBR has predicted the Government’s spending measures are expected to provide a temporary boost to GDP, according to the OBR’s forecast.

But the watchdog predicted downgrades in subsequent years, and said the Budget measures will add to pressure on inflation and interest rates.

Paul Johnson, director of the influential economics think tank the Institute for Fiscal Studies (IFS), warned Ms Reeves may have to come back for “another round of tax rises in a couple of years’ time – unless she gets lucky on growth”.

Meanwhile, the International Monetary Fund (IMF) endorsed the investment and spending on public services in the Chancellor’s Budget, as well as sustainable tax rises.

In an unusual move, the Washington-based watchdog said: “We support the envisaged reduction in the deficit over the medium term, including by sustainably raising revenue.”

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

There is no way that employers will take this on the chin. The first thing they will do is increase the price of whatever they produce to cover the cost of the increased national insurance contribution and a wonderful excuse to add a bit more on for themselves. They will do exactly the same to cover the cost of the increase in the minimum wage. The bottom line here is that the working man/woman will take the hit and not the employers. The buck always stops in the same place.

Really good for working people then!

Look on my works, ye beneficiaries and pensioners and other non-workers, and despair…

Welsh Labour out in 2026!

UK Labour out in 2029!

If only it was that easy to eject them from office ….

Not sure what people were expecting after 14 years of handing the reign’s to Tory mates and big business that never delivered. The Tory party drove the available wealth up, there never was a trickle down. Find out in a year or three how its going. Lots of people got a pay rise and the blood scandal and Post Office victims look to get a result. But the markets didn’t crash out and we are supposed to listen to non dom paper owners and billionaires how its bad (they will never suffer poor). Funnily enough Kwazi Kwartang is saying they… Read more »