Plaid Cymru calls for wealth tax on large corporations

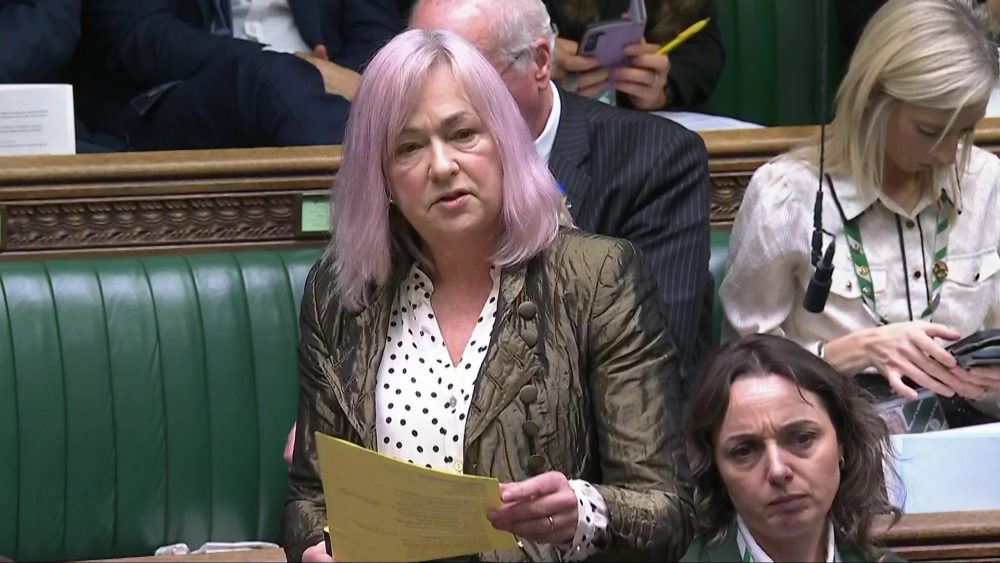

Plaid Cymru’s Westminster Leader, Liz Saville Roberts MP, has urged the UK Government to commit to creating a fairer taxation system, ensuring that ultra-wealthy and large corporations “pay their fair share”

Ms Saville Roberts argued that implementing a wealth tax on assets over £10 million would be a fairer policy.

A 2% tax on assets over £10 million could raise up to £24 billion every year.

She also argued that the UK Government should clamp down on tax evasion as well as end government subsidies for oil and gas giants.

Cuts

In addition to raising Employer National Insurance Contributions, the Chancellor Rachel Reeves MP, has proposed a number of cuts in her first year in office including the Winter Fuel Payment and disability benefits.

Ms Saville Roberts, MP for Dwyfor Meirionnydd, highlighted how these policies disproportionately hit Welsh communities”.

Speaking in the House of Commons, she said: “Plans to plunder disability benefits and the decision to hike National insurance are examples of policies which disproportionately hit Welsh communities.

“Instead, we need fair policies like a wealth tax on assets over £10 million, ending government subsidies for the oil and gas giants and clamping down on tax evasion.

“So, when will the Government’s fiscal rules enshrine fairness where the ultra-wealthy and large corporations pay their fair share?”

Non-dom tax status

In his response, the Treasury’s Chief Secretary, Darren Jones MP said: “I think the Honourable Lady has missed the fact that this Government has changed the non-dom tax status – these are the wealthiest people in our country for many years – VAT on private schools and it’s more expensive now to fly a private jet than under the former Prime Minister under the Conservative Party opposite and as a consequence of the decisions the Chancellor took at the Budget last year, we’ve given the largest real terms increase in spending to Wales since devolution began and as a consequence of our reforms to the Bill coming on Wednesday we’ve increased the base rate of Universal Credit for the first time in many, many years.”

At the weekend, Lord Kinnock, who led the Labour Party from 1983 to 1992, told Sky News there are things the party could do that “would commend themselves to the great majority of the general public” and that these included “asset taxes”.

“By going for an imposition of 2% on asset values above £10 million, say, which is a very big fortune, the Government would be in a position to collect £10 billion or £11 billion,” he said.

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

Brilliant move, yes please.

Won’t work.

‘Brilliant move, yes please’.

The exact words of the Ireland minister for inward investment and enterprise, as he fires off emails to all the companies ready to de-camp over there. He must have been gutted when he found out it was just political posturing from Plaid.

I am sure the money will magically appear from elsewhere. Or just scrap everything else and live in huts and hunt with spears. Everyone for themselves. Most rich folks usually say please don’t tax us. We want to stay rich.

“money will magically appear from elsewhere.” Why does money have to come from elsewhere or someone else? How about the idea of an individual or a country following a system where both can both prosper by hard work and stand on their own two feet, instead of a stay in bed society demanding that the expense of their lives are paid for from “elsewhere”. The idle rich and idle poor are equally guilty of this, living off a decreasing minority in the middle who put a shift in every day. But then all this isn’t about fairness, it’s about playing… Read more »

How about a system where everyone pays an equal percentage of their income each year without trying to evade or avoid. Those who earn significantly more always find loopholes. A one off wealth tax will try to make this system equitable. I agree people should be able to work. Not everyone is born equal or can stand on their own 2 feet. Your lack of appreciation for those who are disabled or infirm is disturbing. The government closed down centres which allowed those with disabilities to continue to work due to costs. Now employers prefer the fully able only.

Nothing magical about it: detain illegal migrants in basic detention centres before swiftly deporting them, scrap Net Zero, start drilling, reduce the size of the state by 20%, the welfare bill by the same, reform the NHS, and cut taxpayer contributions to public sector pensions. Loadsa money!

No offense but your manifesto is childlike in it’s attempt to simplify and wilfully misunderstand complex matters.

A blanket 20% cut of the state would mean 20% fewer prison places. Is that your intention?

The biggest welfare bill is state pensions. How do you plan to cut that?

More drilling won’t make prices cheaper because that’s set by the global market. Who are you trying to fool?

When Reform say reform the NHS, I think they usually mean scrap the NHS.

Deport them where exactly. The Rwanda scheme was a pile of pooh.

Enjoy global warming. Using air conditioning is quite cheap these days.

Clark got the gig on the understanding that it would be over his dead body that the government would tax his landed gentry and corporate backers…so Liz good luck with that…

Getting this Labour government to create a wealth tax would be like trying to get blood out of a stone. Impossible. Westminster is now too tied up to the City of London and all it’s wealth for it to happen. It’s only by breaking completely from the Union that Cymru can start a proper taxation on the rich. Independence is the only way.

If that is the price of independence then the Uchelwyr will have no part in it, be assured of that…

O yes when we are independent let’s have a wealth tax to send the wealth creators scuttling across the clawdd. Great idea.

That’s stupid because when we achieve independence. We want to welcome wealth creators to Cymru not send then fleeing across the clawdd.

Someone owning something expensive isn’t automatically creating wealth (as defined by contributing to GDP).

Most rich folks usually say that. But they never really leave. Others will come. Plenty to invest in here in wales. Energy, manufacturing, tourism, retail.

He doesn’t really answer the question.

Bring on the tourist tax.

Free car parking and good public toilets

Will a wealth tax make people leave?

Spoiler alert….Thie evidence suggests not.

https://www.facebook.com/share/r/15Hvav62Gu/

Won’t this simply prompt businesses to sell their assets to offshore entities and lease them instead.

Ah, some common sense at last. I eagerly await the responses from the “save our billionaires” fanclub.