Welsh First Minister defends UK Government’s controversial changes to inheritance tax

Emily Price

The First Minister of Wales has defended the UK Government’s controversial changes to inheritance tax as thousands of farmers march on Westminster.

Tractors were seen ploughing through barricades as farmers descended on Whitehall on Tuesday (November 19) to demonstrate against Rachel Reeves’ autumn Budget.

From April 2026 inheritance tax for farming businesses will limit the existing 100% relief for farms to only the first £1 million of combined agricultural and business property.

Some farmers warn they will have to sell off land to meet the costs and are threatening to strike over the pressures with many rising concerns about the mental health.

Wellies

The Met Police estimated more than 10,000 people had joined the rally in central London by midday – with “more arriving”.

Shadow rural affairs minister James Evans travelled to Westminster to attend the march in support of Welsh farmers like himself.

In Cardiff, the Welsh Conservative Senedd group – many of whom own farms – arrived at the Welsh Parliament wearing dirty wellies in solidarity.

‘Calm down’

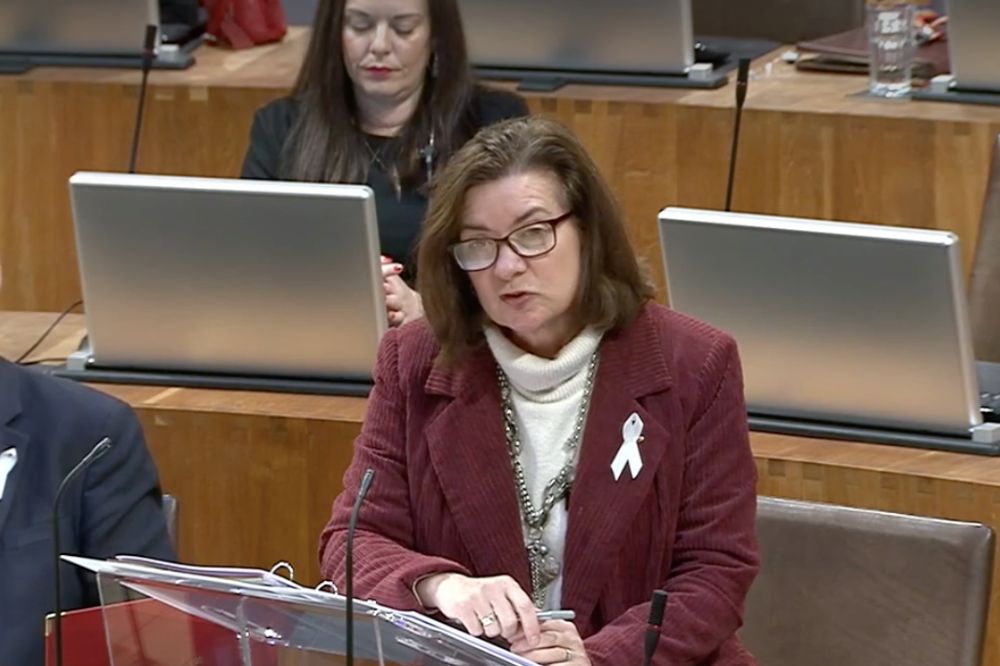

During FMQs, Baroness Eluned Morgan said farmers in Wales were the “bedrock economy” which is why they receive the “highest amount of subsidy”.

She added that the previous Conservative administration in Westminster had left a “black hole” in government finances and that “somebody has to pay for it”

Baroness Morgan also defended her recent plea for farmers to “calm down” which she made during an interview marking 100 days as FM.

Speaking in the Chamber, she said: “To quote me correctly, I was very clear that ‘we’ should all calm down and I think also it’s important for us to be careful here because I think there is a lot of anxiety within the agricultural community.

“The last thing we need to do is to poor fuel on that fire. There are a lot of farmers who are in a lot of stress at the moment and it is important for us to to make sure that we work through exactly the implications for people in our communities.”

‘Unaffected’

Prime Minster Keir Starmer says “the vast majority of farms would be unaffected” by the changes to inheritance tax.

This was echoed by the First Minster who told the Senedd that the Welsh Government had calculated that “very few” would feel the impact of the changes.

Baroness Morgan said the Deputy First Minister with responsibility for Climate Change had spoken with Wales’ farming unions to ensure they had access to treasury data in order for them to make their argument with UK ministers.

She said: “We are taking this seriously and I think what is important is that we recognise that inheritance tax at non-devolved area so it is the treasurer who has those figures.

“The Welsh farmers union will have an opportunity to show their working and the treasury will be able to show their workings and then we need to come to a conclusion on this issue.

“The Welsh government provides significant funding to the agricultural sector not just in terms of general support but also through farming connect to help people with succession planning and if they have fears, I would suggest that they go and speak to them.”

Thresholds

As the protest got underway in London, Keir Starmer reiterated his stance that the “vast majority” of farms will be “totally unaffected” by changes.

Speaking to the BBC in Rio de Janeiro where he is attending the G20 summit, he said that the UK Government had put money into farming at the Budget.

He added: “If you take a typical case, which is parents who want to pass on their farm to one of their children … by the time you’ve built in the other income tax thresholds, it’s only those with assets over £3 million that would begin to pay inheritance tax, and that’s why I’m very confident that the vast majority of farms will be totally unaffected.”

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

About 70,000 farms for the bill in terms of monetary worth. On the one hand you could say that not all farms are about to be inherited, but it’s also true to say that they all will be either inherited or sold at some point. What’s also worth bearing in mind is that this isn’t a one-off tax: it’ll be applied every time a farm is inherited.

Which ever way you slice it, our Labour politicians are either lying or just innumerate.

Lying, innumerate or just a profound hatred of farmers.

All very odd when those of us will longish memories will recall that one of the most active sections of our communities that showed real material support for striking miners way back in ’84 were … Welsh farmers! Grey men in suits or even men in grey suits were rarely seen delivering goods to miners but the men and women in scruffy muddy gear showed real support. I guess that was around the time that Labour and other swanky socialists started backing away from the real working class.

Usual suspect press that were all after the other peaceful protestors are now glorifying this. Funny that.

I still have not seen a capable explanation, I read tax experts input and its not as bad as people think, but listen to Clarkson, its the end of his world.

What other peaceful protesters are you referring to?

‘For the many not the few’…is he doing a pass around Planet Corbyn before out into the milky way (hi, you two) and on to Marxs…

A brief examination of Starmer’s history puts him way left of Corbyn!

New enterants to farming cannot do so as land is so expensive, compared to France some three times the cost. Why is the land so expensive, in large part because of land being used as a financial instrument to avoid paying tax. Remove that reason and there should be a realignment of land prices downwards.

Perhaps government should also do more to stop farmers being screwed over by supermarkets and food processors.

True, but baby & bathwater springs to mind. I imagine most farms are owned by generational farmers, not tax avoiders. There will be a way to amend the legislation to root out the blatant tax avoiders.

Yes indeed. It would also be useful if the Government got over its hatred of the EU and looked at how the same issue is handled in France. The key point there is that to be eligible for the relief the deceased’s principal activity should have been farming. Thus with Jeremy Clarkson it is very clear that his past and present principal activity is TV presenter. His farm is merely the current set for his TV activties. The lady who wrote the anguised piece in the Guardian recently clearly was principally enagged in farming and so should clearly be eligible… Read more »

But why target farmers who want generational inheritance over any other small business owner who wants the children to take over the business? Or a householder with a large house who wants a child (maybe with a disability or low IQ) to continue living in the same house. You can argue food security but farming like any other skill can be learned (eg agricultural colleges) and inheritance still makes entry to the profession incredibly difficult. I think it could be done the way you suggest by lifting reliefs but fully taxing gains on selling land for development and not allowing… Read more »

Labour have made a strategic error on this. No shakes for those in Haringey or Islington, or ever Cathays represented in the Senedd by the Islington billionaire, but in Wales there’s a closer bond between the urban working class and the family farms. Eluned Morgan herself will be a casualty, sacrificing her seat to be Starmers poodle. Painting farmers are wealthy millionaires doesn’t wash in Wales as we have a different landholding tradition. As Labour removes the ‘re-tape’ on bankers bonuses in the City of London they are loading family farms with uncertainty and death taxes. That’s not what voters… Read more »

Take the spoon out of the tea cup. Stop stiring. Show dome empathy with farmers and go after the off shore tax dodgers.

Or is that too challenging?