Welsh tourism attractions to close for St David’s Day

Emily Price

Tourism attractions will close their businesses and fly Welsh flags at half-mast on St David’s Day in protest against the Welsh Government’s proposed tourism tax.

In December several major tourism attractions closed for one day after a resolution was passed in an emergency meeting with the Welsh Association of Visitor Attractions (WAVA).

The trade body represents around 100 tourism attractions in Wales.

March 1st will mark the next stage in the WAVA campaign to convince the Welsh Government to U-turn on some of its tourism policies.

The St David’s Day protest will see other sectors of tourism join the action including the Professional Association of Self Caterers (PASC) in Wales, and North Wales Tourism.

Executive Chair of PASC UK Alistair Handyside said many tourism businesses are now at “breaking point” with mental health issues “rife” across the sector.

Charge

The Welsh Government’s tourism levy will see a £1.25 per night charge for hotels, B&Bs and self-catered accommodation.

There will also be a reduced rate of £0.75 for camping pitches and dormitories.

The tax requires a piece of legislation to be passed in the Senedd. If successful the tax could be introduced in April 2027.

The decision of whether to introduce a levy will fall to local authorities.

The Welsh Government says the tourism tax will raise additional revenue for councils to reinvest in the public services and infrastructure that make tourism a success.

Damage

But the proposals have faced opposition from tourism businesses who say they are already not achieving pre-Covid visitor numbers and a tourism levy could cause more damage.

Concerns have also been raised over a new rule that requires holiday let properties to be occupied for at least 182 days a year to qualify for business rates.

It was introduced in a bid to close a potential loophole where it was feared second home owners could avoid council tax, including at a premium rate, by registering for business rates when homes only had to be let for at least 70 nights to qualify.

The 182-day rule means that legitimate local self-catering businesses have become liable to pay council tax – sometimes at a premium rate.

‘Unviable’

North Wales Tourism CEO Jim Jones says the Welsh Government’s tourism policies have had a “devastating impact” on the sector, rendering many businesses

“struggling and unviable”.

He said: “Despite repeated efforts to engage through normal channels, our concerns have been ignored.

“As a result, we are escalating our opposition and calling on businesses to join us in a symbolic gesture of lowering flags to half-mast, reflecting the profound damage to what was once one of Wales’ most stable and economically significant sectors.”

On March Ist, WAVA members will close their premises and lower they flags to signify their dismay at Wales’ tourism policies.

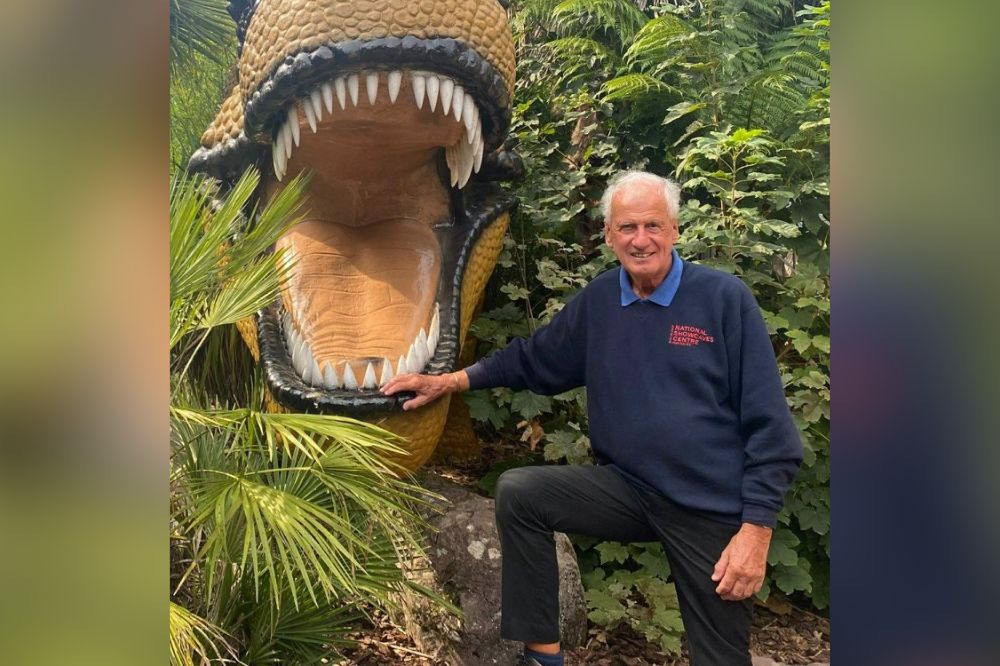

Dan Yr Ogof Show Caves owner and WAVA spokesperson Ashford Price will take part in the St David’s Day protest.

He hit the headlines during the Covid-19 pandemic when he banned former First Minister Mark Drakeford from entering the grounds of his attraction in south Wales.

Tax

Mr Price said: “Welsh people will be the ones most affected by the proposed Welsh Governments tourism tax as 60% of all the accommodation booked in Wales is booked by Welsh people, for their Welsh holidays.

“Thus, even though they live in Wales, and want to support Welsh tourism the Welsh Government is going to tax them for doing so.

“Also, I don’t think Welsh people realise, that their infants, and even babies will pay this tax if they stay in tents, caravans, hotels, or self-catering cottages that are in Wales.”

The Welsh Government said: “Tourism makes an important contribution to the Welsh economy and to Welsh life. We want to ensure its long-term sustainability.

“As set out in the Bill, any money raised would have to be reinvested in the local area to provide and improve services for visitors and residents.

“Visitor levies are used successfully in many parts of the world, including Manchester, Greece and Germany.

“It will be up to local authorities to decide whether to introduce a levy in their area following consultation with local residents and businesses.”

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

Do they have alternative proposals to fund improvements to tourism infrastructure?

It’s time to boycott these businesses then. If their business model is so weak that they cannot survive this tax being introduced. Then maybe they should consider another line off work.

I’m sure they are all quick enough applying for any grants available. Where do they think that money comes from?

I boycotted Dan Yr ogof years ago, because the owner is a complete POS and treats his staff like dirt.

I’ve just come back from 8 weeks travelling in Spain. Almost everywhere I stayed charged a tourist tax, some places as much as €8 for a night. This tax of £1.75 is so minimal, most people won’t even notice (unless these stupid businesses who are part of PASC keep going on about it – yes, we should boycott them as Tucker says).

Charge more I’d say, especially in places where demand is high in summer months. Still, this doesn’t bring in money for day trippers. Tolls/park tickets would be needed for that (e.g. around Eryri).

If the tourism tax is £1.25/ night and an Adult ticket to the Show caves is £21.95. (That’s 17.56 nights at £1.25/night) Closing the doors for St Davids day does seem to be a strange way of letting the public know that your business is not going to cope with the tax.

I don’t think they understand how the tax will work.

How many of their customers will even be affected?

I imagine most are just day trippers who won’t be paying it anyway, and if they do stay overnight it all depends if the local councils that their customers stay in bring it in or not.

There’s not a huge amount of overtourism in the Heads of the Valleys anyway compared to, say, Pembrokeshire or Gwynedd, so I don’t see many councils in that area going for it, so really don’t know what they’re doing this for.

A cynic might wonder if it’s all a party political broadcast by the Welsh Cons.

Duh, noses and faces, not a good look – just when we can enjoy Dewi Sant as it’s a Saturday instead of just those who work in council offices

Is it not against the law to fly a national flag at half-mast for no good reason…

like a dying Monarch…

I get the impression that without permission from the FM to fly the flag at ‘half-mast’ these proud companies are breaking the law…

What say you Welsh Gov…?

The correct term should be ‘two thirds mast’ so the flag is being flown illegally and incorrectly…

A test case against Dan yr Ogof !

Wrong on both points. The correct term is ‘half-mast’ despite the correct position of the flag being two-thirds of the way up the mast. And there are no laws whatsoever that govern any of this, so nobody is doing anything illegal.

I get the impression that you have no idea what you are talking about. The First Minister doesn’t even determine when the flag is flown at half-mast at the Senedd (the Presiding Officer does), never mind anywhere else. And there is no law governing any of this, just protocols that apply solely to government buildings. Anybody else can do whatever they like with any flag they choose.

Regardless of whether or not you agree with a tourism tax, its a bit silly to close on a Saturday, the most busiest day of the week for tourist attractions. It should be a Bank Holiday but thats a different matter.

Yeah, not really going to go there again because of their stance but lets see them close at the first week of school summer hols instead of a wet day in March when the caves will be part off limits anyway.

That will be commitment to the cause.

Charges have never stopped me travelling abroad and it will not stop me travelling in Wales. One of the best holiday destinations going.

The usual gimmicky nonsense we’ve come to expect from the (anti)-Welsh Association of Visitor Attractions.. 🥱

Closing to protest about losing money to a tax of pennies, is kind of the same level of stupidity of pleading poverty to Westminster by hiring a 600 quid a day low loader to use a half million pound tractor to complain that you’re broke.

Obviously, Dan Yr Ogof Show Caves should not be in receipt of any future grants or loans from the Welsh Government or local authority. Years ago these caves were open to the public anyway, no charge. Was only fenced off when an ‘entrepreneur’ acquired adjacent land and decided to theme park it with plastic dinosaurs and overpriced eateries.

This colonialist company again. Boycott.

The most damage will be done by the changes in N.I contributions which take c.£600 per head per annum from the employer in respect of all employees earning up to £9000, which is probably most unless on very low hours. Tourist tax is coppers in comparison. If these people want to pick a fight they should make sure they are confronting the real back breaker for a lot of small and medium businesses.

“I’m so cross I’m gonna shoot myself in the foot!”

Grow up the lot of you.

Tourist taxes work just fine elswhere and there is no reason to object to having them in Wales. God knows is difficult enough to get anything out of the English beyond jokes about vowels and sheep.

And don’t even get me started on Ashford Price and his would-be Disneyland – just scrape all the c**p off and leave the caves alone!

Best boycott those protesting about such a small contribution to Welsh infrastructure and the services their businesses rely on to exist.

I heard Eluned Morgan say that Wales has a rosy future with a Labour Government in London.

Well there is no sign of it at the moment, in fact it’s totally silent. It’s all take and no give in Wales.

Maybe the Senedd could close for a bit longer than a day, weight be better off.

Spellchecker uncorrected me ! It’s “We would be better off “

The levy is a good idea. Why do we sell ourselves so cheaply here in Wales? Have we so little self-confidence?

I think that there is an underlying anti-Welsh and anti-devolution motivation here.

Please print a full list of the venues taking part in this charade, so that I can boycott them in future. Meanwhile we should be protesting about the failure to make Dydd Gŵyl Dewi a bank holiday…

Idiots. Everywhere has tourism taxes, nobody is put off. Now let’s see if our showcases for instance are willing to resurface the road to them.These places have higher car use than the locals alone. So somebody has to pay. Council tax hike OK is it