Working age households predicted to be £400 worse off on average in year ahead

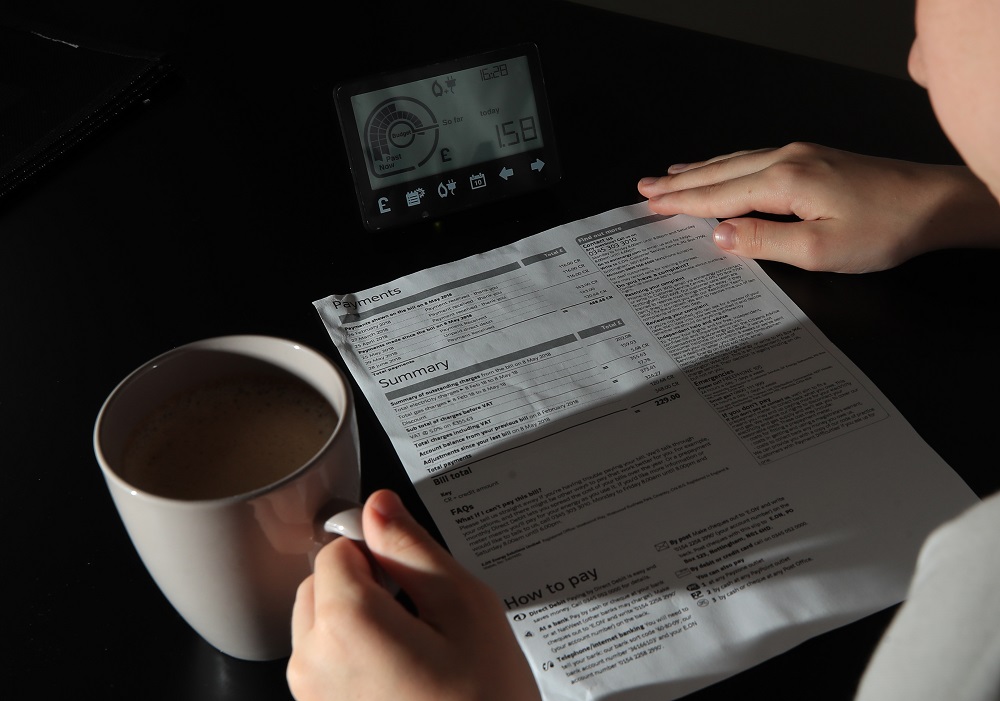

Working age households are on track to be £400 worse off on average in the year ahead amid income squeezes and bill hikes, a think-tank predicts.

As the new tax year gets under way in April, households face a “triple hit” from the impacts of tax, utility bill increases, and benefits that are not keeping pace with the cost of living, the Resolution Foundation said.

Long-running freezes to personal tax thresholds will mean some people are dragged into paying more tax, while employer national insurance (NI) hikes will feed through to households through slower wage growth as employers recoup costs, the Foundation predicts.

Meanwhile, rising utility bills and council tax will put further pressure on household budgets, the report said.

Living standards

The Foundation, which is focused on improving living standards for those on low-to-middle incomes, predicted that working-age benefits will not keep pace with inflation this year, adding that low-income renters will also be squeezed by a freeze on local housing allowance.

However, it described national living wage increases as a “chink of light in an otherwise gloomy outlook”.

Changes from April mean the national living wage for those aged 21 and over rises from £11.44 per hour to £12.21 per hour.

The national minimum wage for 18 to 20-year-olds has been increased from £8.60 to £10 per hour.

But the Foundation said that bringing various changes together, the disposable income of a median average working-age household in the UK is projected to fall by £400 in real terms, when comparing the financial year of 2025/26 with 2024/25.

Financial pressure

It said that while many financial pressures are beyond the Government’s control, quickfire measures can help to ease the pressure on households’ budgets, such as bringing forward increases in the standard allowance of universal credit.

Adam Corlett, principal economist at the Resolution Foundation, said: “The new tax year has arrived, and brings with it higher taxes, even larger bill increases, and benefits that aren’t keeping pace with the rising cost of living.

“The typical household is now projected to be £400 worse off this financial year, due to a combination of weakening earnings growth, rising housing costs, taxes and bills, and benefits struggling to outpace inflation.

“As vulnerable households try to meet these rising costs, the Government can help by bringing forward next year’s welcome universal credit boost to this October.”

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.