Matching state pension to the national living wage would help pensioners maintain their dignity

Chris Parry, Principal Lecturer in Finance, Cardiff Metropolitan University

A question that is perennially asked by financial experts is: “can the government (in other words, the taxpayer) afford to keep increasing pensions?” But in my view, the real question should be: “what is the purpose of the state pension?”

This isn’t an economics question, it’s a moral question. And, as a society, we are poor at discussing moral questions.

A report from the Office for Budget Responsibility earlier this year stated that in the current financial year, the state pension will cost around £124 billion. This is more than the £105 billion education budget and more than double the £52 billion defence budget.

The level of the UK pension is safeguarded by the triple lock, which was first introduced in the June 2010 budget. It means annual increases in payments are made in line with earnings growth, price inflation (currently 4.6%) or 2.5% – whichever is highest.

With another triple lock increase of 8.5% in pensions due in April 2024, the state pension will rise to £221.75 per week (£11,531 per annum). This is only £20 per week less than the personal allowance everyone can earn before having to pay tax or national insurance.

Inflation

Assuming wages exceed inflation and 2.5% in line with the last five year averages, then the pension up-ratings could be in the region of 5% in 2025 and 2026. This will see pensioners, who have no other income, having to pay tax – in some cases, a decade after they last paid income tax.

So, how do we ensure that retired people are able to have a comfortable standard of living once they stop working? As a starting point, we can consider principle 15 of the European pillar of social rights, which was set out in 2017 by the European Union and maintains: “The right of workers and the self-employed to a pension commensurate with contributions and ensuring an adequate income. The right to equal opportunities to acquire pension rights for both women and men. The right to resources that ensure living in dignity in old age.”

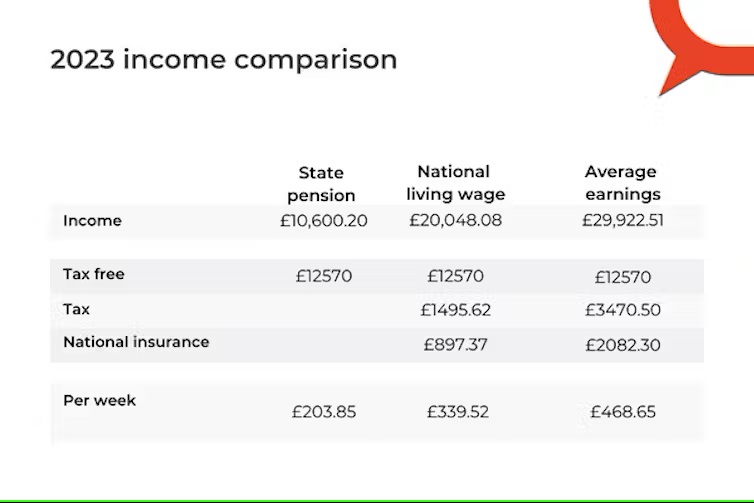

Comparing incomes

The national living wage is two thirds of UK average earnings and should be the minimum to cover “adequate income” and “dignity in old age”. The salary obtained by an adult working 37 hours per week at the national living wage is currently £10.42 per hour. This will increase to £11.44 per hour from April 2024.

Were the UK pension matched with the national living wage, it would be set at a figure of £22,308 per year, and pensioners’ income would be vastly different as of April 6 2024.

Even after paying more than £1,900 in tax, the poorest pensioner would be still be £225.15 per week better off than they are today. And the extra disposable income could be recycled into the economy through increased expenditure, with knock-on impacts in indirect taxes such as VAT.

A European comparison

A recent survey by pension advice firm Almond Finance UK shows the UK is currently 16th out of 50 countries in terms of the best pension offering across Europe. Spain tops the survey, with Belgium in second place and Luxembourg third.

Bringing the state pension in line with the national living wage would move the UK up to fourth position, ahead of Bosnia and Herzegovina, Cyprus, Lichenstein, France, Denmark and Switzerland.

Such an increase would raise the annual cost to the Treasury from the current £124 billion to £236 billion. And such a large increase in expenditure would require more taxes or more borrowing, which would accrue more debt interest in turn. But this sum could be reduced by £13 billion by charging pensioners national insurance.

In a response to an online petition in August, which called for the state pension to be matched to the national living wage, the government said it had “no plans to increase the state pension to equal 35 hours a week at the national living wage”. It went on to describe the state pension and national living wage as having “different purposes” and said that a direct comparison could not be drawn between the two.

With the focus on cutting both business rates and national insurance in the autumn statement, it’s worth considering how those measures will help to ensure that pensioners live in dignity in old age.

This article was first published on The Conversation

![]()

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

As a pensioner, I declare an interest! Chris Parry’s excellent article places emphasis on where it should be – treating elderly people with respect and allowing them dignity. A moral issue if not anything else. And that goes for everyone else as well. The ‘living wage’ is not adequate given today’s cost of living. There are many who are poorly paid. While more taxes and/or more borrowing (and possibly interest on it) would be anathema to the Treasury and the government, hell-bent on reducing the value of what we are all paid, no action is likely. But there is another… Read more »

Funny how wealth never trickles down, despite the claims from the Cons. It aways trickles up. This leaves millions close to the edge whilst the small percentage of richh will never have to worry ever again.

It’s not so much an upwards trickle, but more of a torrent.

There is no way of funding this. Giveaways to billionaires are much more important, so the money isn’t there.

Whilst Chris makes a thought provoking contribution, I reminded of the views of my deceased mother, Hilda, who at 90 year old was a very active member of Welsh Governments National Partnership Forum for Older People (2000-2007) One view strongly advocated state pension income to the exclusion of other matters. Another, which Hilda strongly advocated, was that vulnerable older people require good public services. For example, good Primary Care and GP’s with a grounding in gerontology; Community Pharmacy and effective medicine reviews; Public Transport to help overcome isolation; access to community support services rather than help with a shower in… Read more »

Most of those things sound like what we should be expecting and demanding for everyone, not just those of us who are ageing, things that any civilised society would without question be providing! I’m a bit unsure about the general thrust of the argument to make the sum of the national minimum wage. At present the only reason why income tax could be applicable it because the tax free threshold hasn’t been increased for some years, which has meant that more and more poor people now pay income tax as well as the various stealth taxes they already pay (tax… Read more »

Both of these things should be possible in a healthy economy. But successive governments (even moreso this last 13 years) has been robbing the state and selling off our assets to cover their own incompetence and fraud. We need a strong government that says taxes are going up (even for the megacorps), to give you the services a first world country needs. Everybody wants more money in their pockets, me included. But as a nation, we have to pay for the things we want, like affordable public transport, a funded NHS, something resembling NHS dentistry etc. When the state provides… Read more »