Second homes and tourism taxes in Wales: It’s fair play to pay

James Downs, Campaigner and Researcher

Council tax premiums on second homes and the introduction of tourism taxes in holiday hotspots are polarising issues in Wales today.

While critics decry these policies as unfair or damaging to local economies, basic questions of fairness and sustainability can get lost in the noise.

Concern on both sides of the debate reflect real challenges in ensuring that those who benefit from Welsh property and resources contribute beneficially to the communities they affect.

Yet, instead of meaningful discussions about shared problems, we too often fall into a discourse of division and fail to see the bigger picture.

Why do policies affecting wealthier second homeowners or tourists face such resistance, while the broader struggles of local communities and the impact of other taxes receive far less attention? What are we missing?

Tourism and second homes: A question of balance

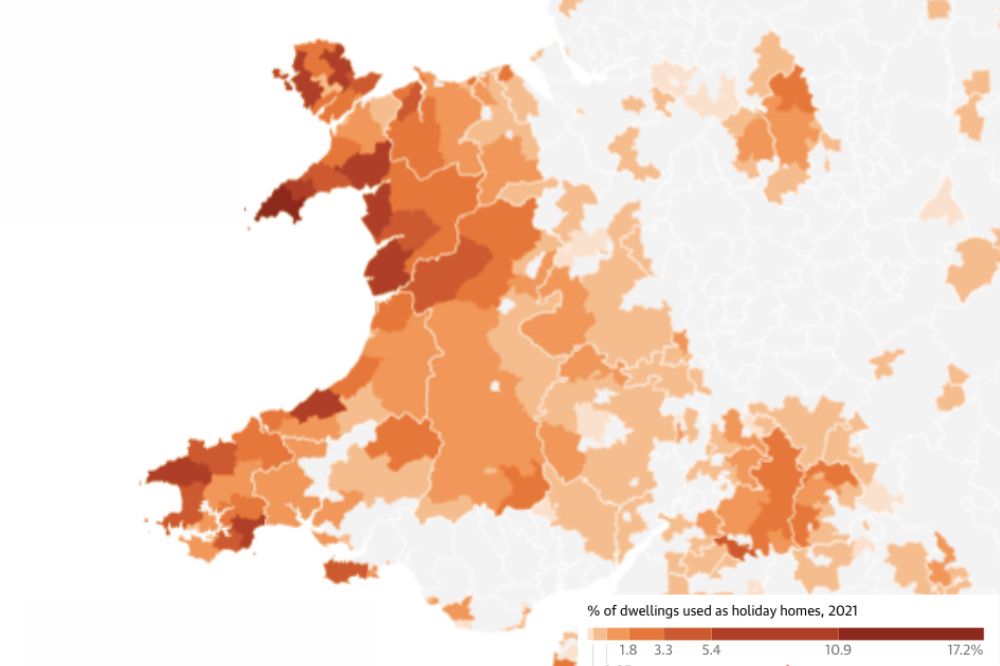

In parts of Wales, councils can impose up to a 300% premium on council tax for second homes and long-term empty properties.

These measures aim to address housing shortages, provide much-needed funds for overstretched councils, and support communities struggling with the dual pressures of high property prices and declining affordability.

The underlying goal is to ensure that second homes and holiday lets contribute more fairly to the areas they affect.

At the same time, Wales is considering introducing a tourism tax – a small levy on overnight stays in hotels and other accommodations.

This would help fund local services and infrastructure used by visitors. Together, these policies reflect a broader effort to balance the needs of year-round residents with those of visitors and second homeowners.

Despite the measured nature of these policies, they have provoked significant backlash.

Critics of the council tax premium argue that second homeowners inject disposable income into local businesses, while opponents of a tourism tax claim it risks discouraging visitors.

But these arguments obscure how second homes and tourism bring costs as well as benefits. They drive up house prices, reduce housing availability, and strain local services, particularly in rural and Welsh-speaking communities.

Asking those who benefit from these arrangements to contribute more isn’t punitive – it’s pragmatic.

A bleak argument for dependency

Underlying much of this opposition is a strikingly bleak view of Welsh communities: that they cannot survive without the wealth of outsiders.

Opponents of these taxes often imply – correctly – that local economies are entirely reliant on tourists and second-home owners in order to function and survive.

But this argument is as self-defeating as it is short-sighted. Communities should be able to sustain themselves. They should not have to rely on imported or temporary wealth to fund basic services or remain viable.

Policies like the council tax premium and the tourism tax are tools to ensure that communities retain control over their futures and benefit more directly from the economic activity they support.

Framing these measures as hostile or unfair simply avoids the uncomfortable truth that many rural and Welsh-speaking areas are already being hollowed out by unchecked second-home ownership and short-term lets.

So much for the benefits tourism and second-home owners apparently bring.

Confected Outrage

What’s remarkable is how much energy is spent opposing these measures compared to other property taxes that affect a far greater number of people.

In Wales, first-time buyers like myself pay the Land Transaction Tax (LTT), which replaced stamp duty in 2018.

Unlike in England, Wales offers no exemption for first-time buyers, meaning we pay the same rates as anyone else purchasing a property.

To put this into perspective, when I recently bought my first home in Cardiff, I had to pay several thousand pounds in tax.

Had I done the same in Cambridge, where I lived before returning to Wales, I wouldn’t have paid a penny on the glorified cupboard I could have afforded to buy there.

Yet, there is no media outrage about this tax, no letters to the editor lamenting the plight of first-time buyers in Wales. Nor do I think there should be.

If I am lucky enough to be able to buy a property, it’s absolutely right that I pay my fair share. Just as I should pay this tax to fund vital public services, it is only reasonable to ask more of those with second homes, or properties generating income through holiday lets.

The absence of debate about people buying their first home compared to the noise around those with the luxury of owning multiple homes reveals just how skewed this debate really is.

The bigger picture: Building resilient communities

The Welsh government’s approach to property taxes and tourism reflects an effort to address structural inequalities and strengthen local communities.

Far from being anti-tourist or anti-investment, these measures are about creating fairer, more balanced relationships between those who live in Wales full-time and those who benefit from its resources part-time.

Ultimately, the question isn’t whether tourism or second homes are “good” or “bad” – it’s whether the economic activity they generate benefits the communities they rely on, rather than undermining them.

Tourism should not come at the expense of housing affordability, and second homes should not hollow out communities. These are not unreasonable expectations.

Any outrage may be more justified in relation to the harm many communities have already sustained via ill-judged approaches to property and taxation in the past, to the extent that any threat to the tourist pound is seen as an existential challenge today.

Paying fairly for a stronger Wales

Instead of fighting over straw men, we need to channel protective anger for those people and places that we love into mutually-beneficial policies for a fairer future.

Wales faces significant challenges in creating affordable housing, sustaining its language and culture, and funding its public services.

Policies like council tax premiums, tourism taxes, and tighter regulations on holiday lets are not about punishing outsiders; they’re about ensuring that Welsh communities remain liveable for the people who call them home.

Communities deserve the chance to be self-sustaining and resilient.

If I, as a first-time buyer, can pay my fair share to support public services, it’s only reasonable to expect the same of second homeowners and tourists.

Rather than seeing these measures as hostile, we should embrace them as a necessary part of building a fairer and stronger Wales.

James Downs is a mental health campaigner, researcher, psychological therapist and expert by experience in eating disorders.

He lives in Cardiff and can be contacted at @jamesldowns on X, Bluesky and Instagram, or via his website: jamesdowns.co.uk

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

What a bloody great article.After stripping out the emotion a very balanced and well argued call for these very much needed taxes was made.

This argument must allways be made with the problems of the communities that these taxes seek to help allways being to the forefront.Iparticulary liked the self defeating argument part.

Thank you – I wasn’t sure whether it would strike the right tone. The self-defeating thing seems a bit like learnt helplessless, this is the best we can do kind of thing. Which of course is the only thing that many communities trying to survive can do – nobody can blame people for wanting to preserve and protect their only sources of income. But on a policy level we need greater ambition that means such dependence isn’t necessary – the money from these taxes could help reshape economic opportunities in such areas…

Definitely not enough taxes yet, I say get window tax going as well. Where is all the money going?

Strange how Mr Drakeford seems to make himself immune to paying for his second home though isn’t it

Yes spit on article indeed

Fed up of hearing negative attitude to second home taxes from property owners, agents and media when it is one of the drivers of shortage of affordable rented properties too.

People obviously don’t like their profit margin going down on investments such as property, but taxes need to come from somewhere….!

It appears Mr Downs that you have fallen into the same trap that many have done before you. When you talk about property investments I assume you include rental properties? When governments cheered on by campaigners place additional taxes on landlords what do you think happens? The additional burdens gets past on partially or in full to the tenant.

When this proposal was first announced, BBC Wales sent a reporter to Llandudno to test the reaction of tourists strolling along the promenade. Inevitably it was only a small sample, but only one elderly couple expressed hostility to ‘having to fork out even more’ when they went on holiday. The rest said that a levy of around £1:25 a night struck them as insignificant, one commenting that she’d be quite glad to pay towards the maintenance of such a beautiful place. I think reports of adverse reactions to this levy have been overstated. Levies of this sort are common in… Read more »

It does seem to be a very small minority of people that have problems with tourist tax anywhere in the world.

Knowing that I was helping to support a countries culture and environment by paying a small charge would actually encourage me to visit somewhere.

I’m off to Rome next month. It’s now 7 or 8 euros a day.

It’s not stopping us from going.

Yes, people don’t seem to be up in arms about the amount of money they pay in booking fees to AirBnB, either!

Spain has a good idea to deal with second homes etc. https://uk.yahoo.com/news/spain-property-tax-british-tourists-eu-134749815.html

Meanwhile in Hen Ogledd:

https://talkingupscotlandtwo.com/2025/01/16/news-you-wont-hear-snp-legislation-slashes-second-home-ownership-and-empty-properties-in-just-one-year/

Mr. Downs is right that the emphasis regarding tourism and holiday homes should be on protecting and safeguarding local communities from the impacts of both. It seems self-evident that this is a primary duty of any national government (including the Welsh Government) or local authority. He is equally correct in arguing that such communities should be helped to become economically self-reliant, even prosperous, without having to rely almost exclusively on the Faustian pact with tourism, whose disadvantages clearly outweigh its benefits, especially in Welsh-speaking rural or coastal communities.

Thank you – this requires a real re-imagining of rural/remote communities, but there needs to be a vision and strategy for it. One that moves beyond the taxes I am supporting, as well…!

It’s a very well reasoned article. I’m a second home owner, my wife is a native Welsh speaker I am a learner. I’m happy to pay my council tax but I don’t really understand why it’s necessary for me to pay a premium for services I use less than full time residents. In Pembrokeshire, this money is not used to create affordable housing as the policy states it should be but is simply absorbed into the local authority budget. A small tourist tax seems entirely sensible and spreads the load.

You’re not paying a premium for services. You’re paying compensation to the community for taking a habitable property out of use as a main residence during a housing crisis. If that revenue isn’t being used to increase the supply of social housing then that’s for voters to keep in mind when they next choose their councillors.

This ignores the elephant in the room , there are insufficient jobs in Wales , particularly well paid ones . There is no right to live in the area you were born , it was always accepted that often you would move away for work and return if you wished . You If the Welsh government of the last 25 years had put some effort into concentrating on supplying the huge customer on its doorstep and producing a dynamic economy as a result then they wouldn’t be grotting around in every area trying to dream up ideas for more tax… Read more »

The better jobs argument is fine but unrelated to second homes because every community needs affordable housing otherwise there will be no-one to be carers, teaching assistants, work in hospitality, work for the council and so on.

I’m a second home owner in a small touristy place in Gwynedd, my parents live fairly close and the house is useful for keeping an eye on them as they age, but we’re also tied to the place in England that I’ve lived in for over thirty years because my mother in law is in her nineties. I speak Welsh and I view myself as being a part of my community in Wales. We’ve been subject to a 150% council tax surcharge for a couple of years now. We bought our place in the early 2000s and at the time… Read more »

Brilliant of you to share your experience – really brings a lot of things to life. Thank you. I wouldn’t say it is the fault of second home owners, more the policy approach to all of these issues, including the ones you have raised. It seems there is no planning, just measures now that so much negative change has happened. Perhaps such measures would be more acceptable in wider discourse if they were seen to bring about actual change, as you say.

I agree with labour every working person should donate all their wages to labour and then labour can give us pocket money. Are politicians wages means tested? Are their expenses means tested? Did king Charles pay inheritance tax when he inherited the throne? Did prince William pay inheritance tax when he inherited the princes crown. Where do all the taxes go, when paid?

A quote from the past,

‘On the whole, second homes are a visible and perhaps convenient scapegoat whilst the less tangible underlying causes of ‘community decline’-a failing economic base and the changing nature of family life-are less visible and are becoming more difficult to address […] for politicians-in particular-the occurrence of second homes provides an opportunity to present local problems as being externally driven, caused not by failures in the immediate economy or by misjudged policy interventions, but by the greed and carelessness of outside interests’.

(Gallent, Mace & Tewdwr-Jones, 2005; pp.39 &222)

Great article. Communities should be self-sustaining, but many fail to support their own services and businesses. Take St David’s, for example: instead of shopping locally, many residents rely on Tesco home deliveries from Haverfordwest, leaving local shops struggling. Similarly, pubs and restaurants are almost entirely reliant on visitors to stay afloat. Ironically, the one cause locals seem to unite around is the campaign to tax second-home owners. The reality is that second homes are essential to compensate for the lack of community support for local services and shops. Currently, there are over 20 homes for sale in St David’s, further… Read more »

Thank you. Such a good example. I am left reading these responses questioning where on Earth the policy vision is for these communities. It doesn’t seem to be that we have one here in Wales.

So the man that’s imposing all these taxes gets away with not paying his share for his second home, strange that🤔

What a load of baloney. What about the non wealthy owner of a second property who bought a semi derelict property 30-40 years ago that no one else in the are was interested in. Then spend the next 15-20 years pouring blood sweat and tears (literally), and a serious amount of £ that they diddnt really have into local trades and materials suppliers. Then variously over the next 20 years used the house themselves, rented it out as a holiday let, then rented it out as a long term let. Only to find that now when they finally can use… Read more »