The Family Farm Tax: another nail in the coffin of agriculture in Wales?

Cefin Campbell, Plaid Cymru MS for Mid and West Wales

Agriculture is one of the cornerstones of the economy and indeed of wider society in Mid and West Wales.

Our family farms support a way of life that has existed for centuries, support community life in all its diversity and of course contribute greatly to the local economy.

Furthermore, 43% of those working in the sector are Welsh speakers, the highest of any industry in Wales, and it is responsible for maintaining traditional Welsh-speaking communities in large parts of the language’s traditional strongholds.

That is why Plaid Cymru and I are so concerned about the effects of the Westminster Government’s policy to change the inheritance tax for agricultural assets – the so-called ‘Family Farm Tax.’

Debate

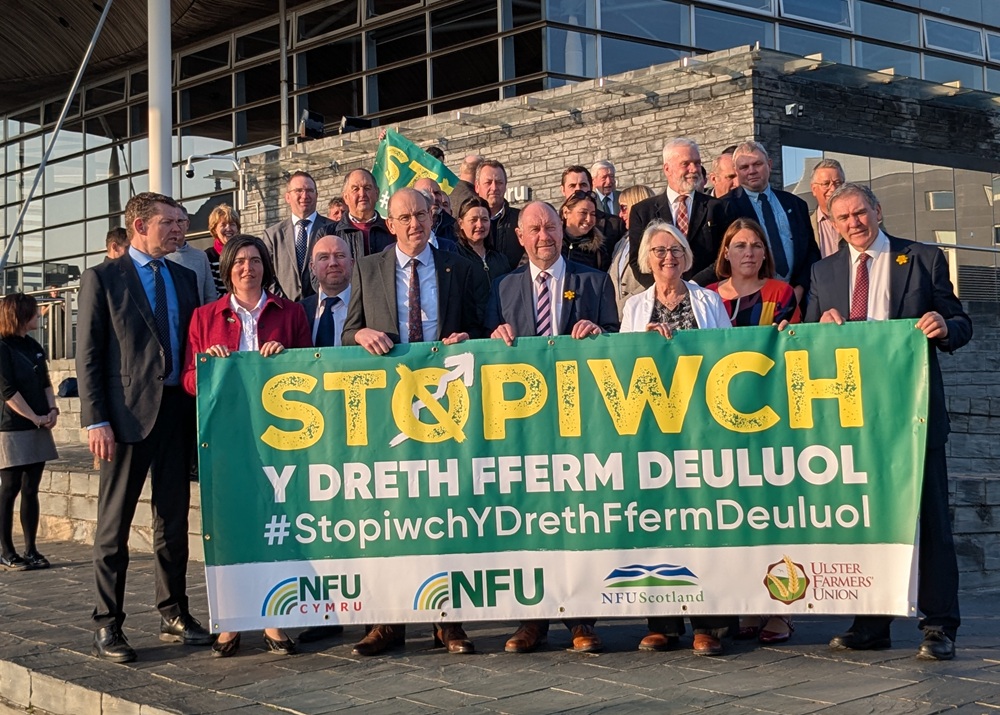

It is also why Llŷr Huws Gruffydd, Plaid Cymru Member of the Senedd and our party’s spokesperson for rural affairs, led a debate in the Senedd recently calling on the Welsh Government to use their “partnership in power” to put pressure on the UK Government to delay the introduction of the tax until they have carried out a thorough economic review of its impact on working farms.

A few weeks ago, Ann Davies and I, the Member of Parliament for Caerfyrddin, had a meeting in Llandeilo with representatives of Carmarthenshire and Pembrokeshire NFU branches regarding the threat that the proposed policy change to inheritance tax means to them.

Among the members present were representatives of the younger generation, who could possibly be the ones most affected by the tax. They were very emotional in reporting their worries and fears of not being able to pay the tax and not being able to continue their families’ succession on the land, which stretched back over many generations. It was a heartbreaking experience.

Challenges

They told me what I have heard from a large number of farmers in my region over the past few months, that this is another nail in the coffin of the agricultural sector in Wales, and adds to the many other challenges that the sector has been facing for many years, including the dreaded acronyms – SFS, NVZs and TB. Adding the proposed change to inheritance tax to the mix may tip many of these farms over the edge, leading to forced land sales, exacerbating financial instability, and undermining inter-generational family-owned companies that have worked their land for time immemorial.

Take, as a hypothetical example, a farm run by an elderly couple, with a hundred cows and two thousand sheep over eight hundred acres, which just about breaks even each year.

It is a fairly common model in my region, and one that many will recognize. Assume that the farm is inherited by the couple’s children, and that its value – between the land, buildings, machinery and livestock – is £4.8 million. With the new tax, the couple’s children would have to find £43,000 each year for ten years in order to pay the £430,000 owed to the Treasury. How on earth would they be able to pay this without selling land and property, threatening the future viability of the business altogether?

Others – including the UK Government – have tried to play down its impact, saying that a relatively small percentage of farms will be affected: around 27%, they say. However, it is worth noting that the NFU’s research shows that there are large gaps in the way this has been calculated, that it is based on old, misleading data, and that the true figure is 75% of farms.

Fundamental problem

In a way, this is the fundamental problem. We have little idea what the implications of this policy change will be, as no thorough economic assessment of its impact has been carried out.

Unfortunately, this is a familiar tale for farmers in my region: that there is a lack of understanding in the corridors of power over the reality they face. This situation is clearly not good enough, and the effects of policies like this one, which have the risk of undermining so many of our farms and communities, must be fully assessed before being introduced.

- The NFU’s study on the percentage of farms that will be affected: https://www.nfuonline.com/updates-and-information/an-impact-analysis-of-apr-reforms-on-commercial-family-farms/

- NFU Wales’ study on the impact of introducing the change to the tax on example farms: https://www.nfu-cymru.org.uk/news-and-information/how-much-could-a-family-farm-pay-under-the-new-iht-reforms/

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

Surely the banner should read “Aroswch”?

Stopiwch werthu tiroedd ein hynafiaid i gwmnïau tai gwladychol

Biwtifwl.

Another article that doesn’t propose alternative ways of stopping the super wealthy non farmers buying farmland to avoid IHT.

The calculations in this article don’t consider that the value of farm land will fall when it can’t be used for aggressive tax avoidance.

The price of land will not fall, between wealthy commuters who ‘want a bit of land for Jocasta’s horsey’ and more importantly agricultural multinationals like Cargill, they won’t be paying any inheritance tax because corporations don’t die, & if you think farmers are bad, wait & see what you get from Cargill & the like…

It may not become worthless but less demand from the Clarksons will have an effect. The price of farm land in the future should better reflect the profits that can be made from actual farming as opposed to the gains possible from tax avoidance. No corporation will pay more for land than is worthwhile after the loan repayments are deducted from the revenues.

That interpretation of factors that influence land prices fails due to the fixed amount of land that is ever available. Indeed as population grows further and land gets taken for housing, and more marginal land gets taken for projects like solar and wind it is arguable that prices will inevitably creep up anyway regardless of whether that perverse demand from tax dodgers continues.

Obviously if you allow farm land to be used for other purposes then all bets are off.