What does the Welsh Government’s budget mean for councils?

Mike Hedges – MS for Swasea East

The Cabinet Secretary for Housing and Local Government, Jayne Bryant, has announced that local authorities will receive £6.1bn from the Welsh Government to spend on delivering key services.

This is a 4.3% rise in the local government settlement compared to 2024/25. A further £15 million support for social care is included in the Health and Social Care budget. Funding for local authorities for this year (2024-25) worth £120 million has already been announced to cover the pay pressures and provide other financial support.

When looking at the local government settlement the key data is the Standard Spending Assessments that are intended to reflect variations in the need to spend which might be expected if all authorities responded in a similar way to the demand for services in their area.

Standard spending assessment funding is the sum of three elements. Nondomestic rates plus Council tax plus the Welsh government rate support grant. The nondomestic rates element is an authority’s allocation of redistributed non-domestic rates.

Data

Councils do not keep the non-domestic rates they collect. In Wales, this is shared based on the authority’s proportion of the population aged eighteen and over; not upon the rates collected in the area.

The data used to calculate the distribution of standard spending assessments across the service areas are collected from various sources, most on an annual basis. The exceptions are the settlement and dispersion data, which are based the Census and selected indicators derived from Censuses.

Other data is collected directly from councils including numbers of pupils, planning applications, street lighting units, lengths of road, lengths of coastline, homelessness, and housing data.

Expenditure

Data on the numbers of dwellings is provided by the Valuation Office Agency along with food and trading premises data. Population projection figures for local authorities are prepared by the Welsh Government Knowledge and Analytical Services Division.

In a small number of cases the actual, or best estimate of expenditure on a service is used, where the expenditure is predetermined and is not directly under the control of authorities.

The formulae for all services were reviewed ahead of the 2001-02 Settlement following recommendations made by an independent review undertaken by Swansea University and Pion Economics.

The recommendations were incorporated into the 2001-02 and subsequent settlements as the necessary analyses were completed, through the mechanism of the Distribution Subgroup.

Support

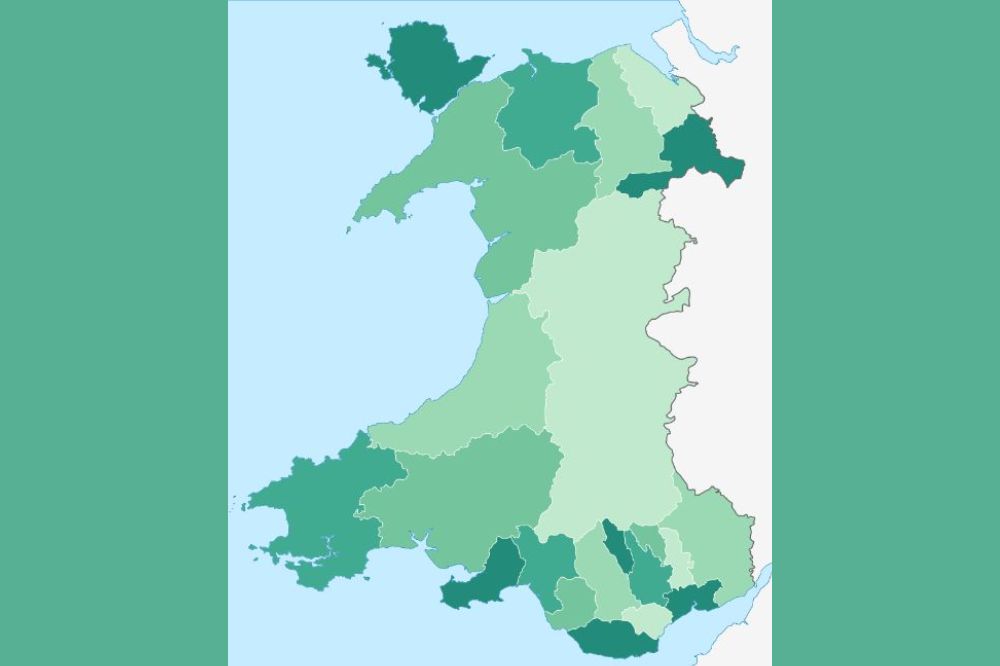

There are three main tables produced on Welsh Government support for councils and the one that generates the most interest is the percentage increase. For 2025/26 the percentage change in Welsh government support varies between 5.6% in Newport and 5.3% in Cardiff to 2.8% in Monmouthshire and 3.2% in Powys.

These variations between years are driven by relative population change. The increase in the population of Newport and Cardiff is well documented.

The second table is the absolute amount provided to each Council by the Welsh government with Cardiff the highest at 674,571,000 followed by Rhonda Cynon Taff at 521,279,000 which are the two of the three largest authorities in Wales. The lowest is the smallest which is Merthyr Tydfil with 133,148,000.

Councils are not wholly funded by the Welsh government; they have the ability to raise council tax and collect fees and charges. Using discretionary fees and charges is one of the key income-generating options available to local authorities.

Authorities are allowed to charge for services that they have a power (but not a duty) to provide. And while the income they can earn from these charges is restricted to the cost of providing them, there is no restriction on how the costs are calculated.

Fees and charges cannot be used to make a profit, they could provide the opportunity to invest in infrastructure, because all aspects of service provision can be included in the cost.

Extremes

The third table is the most meaningful which shows the Welsh Government (AEF) per capita. This varies from the highest Blaenau Gwent £2294, Merthyr £2272 and Denbighshire £2215 to Monmouthshire £1414 and Vale of Glamorgan at £1658 with support for the other Councils being between these extremes.

This shows that Monmouthshire and the Vale of Glamorgan have substantially less that the other Councils in Wales with Blaenau Gwent, Merthyr Tydfil, and Denbigh having substantially more.

Blaenau Gwent has at 58%, the highest proportion of dwellings in band A with Merthyr Tydfil having over half of its properties in band A. In contrast Monmouthshire has 1% of properties and Vale of Glamorgan less than 3% in band A.

Monmouthshire has ¾ of its properties in band D and above whilst Blaenau Gwent has 10% of its properties in Band D and above.

From the above it is clear that Monmouthshire raises substantially more with a 1% rise in band D council tax than Blaenau Gwent. The councils with the ability to raise more council tax on a band D property (the band value on which Council tax is calculated) get less support from the Welsh government.

The system could be improved by publishing the calculation for Standard spending assessment for each authority. This must exist in order to calculate the Welsh government support.

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

Mike. Here’s a question that no Labour councillor seems able to answer. Since a significant proportion of public sector workers are now working from home, and the plan is for this to continue, why is the tax payer still funding all the empty office space? It makes practical and financial sense to consolidate staff into fewer buildings or office floors, with the remaining space being sold or leased. No private business would waste money on unused space.

I know Swansea council are reducing their office space. Of course teachers, social workers and highway workers are not working from home

Well, there’s complete radio silence from NPT councillors on this, despite eye-watering council tac increases: we’ll see what they have to say come the local elections. A small correction though: it is not uncommon for teachers and social workers to work from home…less so highway workers.

How do teachers teach fro home. Social workers can carry out report writing at home but obviously not visits, carers by their job description have to work at other people’s homes

Social workers are.