News in brief: Delyn MP dubbed a ‘clear and present danger to staff’ as he prepares for Westminster return

The Labour Party’s Deputy Leader Angela Rayner has described shamed MP Rob Roberts as a “clear and present danger to staff” and demanded that he stays away from Parliament.

Her comments on Twitter come as Mr Roberts prepares to return to the House of Commons today after serving a six-week suspension over a sexual misconduct ruling.

The MP for Delyn confirmed to the Daily Mirror that he intended to return to Parliament physically rather virtually this afternoon and denied reports that he was advised to stay away from Westminster by the Conservative Party after the whip was removed following the guilty verdict.

Stay away from Parliament Rob Roberts.

You are a clear and present danger to staff, you should not be an MP for another day longer.https://t.co/O76GS9mX9H

— Angela Rayner (@AngelaRayner) July 14, 2021

Mr Roberts was banned for six weeks after Westminster’s Independent Expert Panel found he had breached Parliament’s sexual misconduct policy after investigating a complaint made by the MP’s male former senior parliamentary assistant.

Suspensions of more than 10 days usually trigger a recall petition and potentially a by-election if it is signed by enough voters in the constituency.

However, the panel that looked at the Roberts case was set up only last year, and the legislation covering recall rules was not amended to cover it.

The UK Government has been urged to introduce emergency legislation to close a loophole that is preventing a by-election in the seat.

A female former parliamentary intern, who Mr Roberts propositioned in a series of text messages last year, says she will also make a formal complaint to Westminster’s Independent Complaints and Grievance Scheme if he refuses to step down.

Sexually harassed

Shadow Leader of the Commons Thangam Debbonaire said: “Most people found to have sexually harassed their staff like Rob Roberts has been, would expect to lose their job.

“Because of a procedural anomaly, Rob Roberts’ constituents are not able to decide whether or not they want him to represent them anymore.

“The Tory Party has failed to deal with their MP’s behaviour and now we hear they are still propping him up.

“I’ve proposed a change which could sort this. The government could and should grant time for a debate and a vote.

“They cannot and will not say why they don’t believe this loophole should be fixed to ensure Rob Roberts’ constituents get to decide if they want him to lose his job. Yet again, it’s one rule for them and another for everyone else.”

A spokesperson on behalf of the Whips Office said: “Rob Roberts now sits as an independent MP and his actions are his own.”

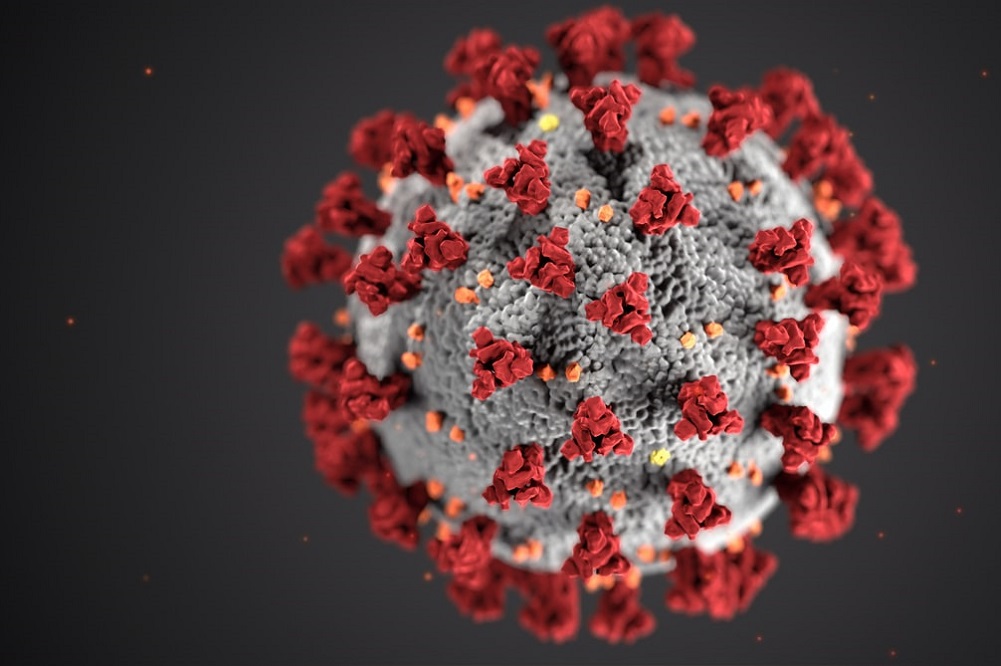

Over 1,000 new Covid cases recorded in the last 24 hours

There has been one further death due to Covid and 1,135 new cases of the virus, according to today’s bulletin from Public Health Wales.

The newly recorded death was in the Aneurin Bevan Vale health board area and takes the total number of deaths since the start of the pandemic in Wales to 5,581.

Cardiff (165) reported the highest number of new cases in the last 24 hours, followed by Bridgend (88) and Denbighshire (66).

Wrexham continues to have the worst weekly case rate in the country at 318.5 per 100,000 people, down from 330.3 yesterday and the positivity testing rate has also fallen from 14.4% per 100,000 tests to 14.2% since yesterday’s report.

The national case rate has climbed to 145.3 from 138.3 and the positive test proportion has also risen, to 7.6% from 7.3%.

The 4,581 positive tests for coronavirus in the seven days up to 9 July is the highest since the week ending 24 January when 5,631 new cases were reported.

Conservative councillor in Panama row steps down

A Conservative councillor from Wrexham, who has been criticised for working in Panama and carrying out his council duties remotely, has resigned.

Andrew Atkinson, Wrexham Council’s lead member for children’s services, has recently been working and attending meetings from Central America and told the Local Democracy Reporting Service he was in the country with his family on a “working holiday” ahead of emigrating there permanently at a future date.

The local authority’s children’s service department’s is facing close scrutiny from Care Inspectorate Wales, which identified “significant concerns” in how it operates last September.

Mr Atkinson’s decision to quit was announced during and Executive Board meeting yesterday and will take effect from the 31 August.

In a statement, Mr Atkinson thanked members of the council for their “professionalism and dedication” and said it had been a “privilege to work with them”.

Cllr Atkinson previously stood for the Conservatives at the 2015 and 2017 UK general elections, finishing second to Labour’s Ian Lucas on both occasions.

He also ran for the Welsh Senedd in 2016, where he was beaten by Labour rival Lesley Griffiths, before being elected as a councillor in Gresford the following year.

Campaigners call for £2bn fund to halt investment in coal, oil and gas companies

Campaigners call for £2bn fund to halt investment in coal, oil and gas companies

Gareth Williams, local democracy reporter

Campaigners have called on a multi-billion-pound pension fund to withdraw its investments from coal, oil and gas companies amid claims that time is running out due to the climate emergency.

A demonstration was held in Caernarfon by members of Divest Gwynedd, which says that over £50m is currently invested in fossil fuels while urging “decisive action and a published timetable for divestment.”

The Gwynedd Pension Fund manages a pot worth over £2bn for Gwynedd, Ynys Môn and Conwy council employees, North Wales Police, Cartrefi Conwy, Cartrefi Cymunedol Gwynedd, Snowdonia National Park Authority and 36 other employers across the north west of Wales.

Controlling money put away by public sector workers for their retirement, the fund supports low carbon initiatives through its direct investment portfolio but also retains large holdings in fossil fuel industries.

After Gwynedd Council declared a climate emergency in 2019, a decision was made to transfer 12% of the pension fund into low-carbon investments via the BlackRock World Low Carbon equity fund.

This particular fund seeks to invest in green infrastructure projects, such as renewable energy, alternative fuels and clean technology, looking to optimise returns as well as “delivering positive environmental outcomes”.

But according to campaigners, while there has been a reduction over recent years, more action is needed.

Draped in black costumes, signifying the role of oil and gas in global deaths due to climate change and a clock representing time running out, Monday saw the group deliver a letter claiming that fund managers are not acting quickly enough.

A spokesperson said: “Unfortunately, acting fast is precisely what they are not doing.

“They are risking people’s pensions by potentially creating stranded assets. They could be looking at opportunities to invest in renewable energy projects in Wales.

“Current scientific assessments suggest that if we are to stand a chance of staying below two degrees of global warming, we must stop burning fossil fuels as soon as possible and certainly not explore for more.

“The catastrophic future consequences of continuing to use these fuels will lead to an increasing number of extreme weather events directly attributable to climate change, such as the recent record breaking heatwave in Canada which resulted in hundreds of deaths.”

Another member added: “There are clear environmental and social non-financial reasons to divest.

“Many other local authority and other pension funds have committed to divestment. All have a fiduciary duty to their members, so why can’t Gwynedd?”

According to the fund, “significant steps” have already been taken with Russell Investments – the Wales Pension Partnership’s management solutions provider – and other partners declaring that they want to achieve a standard of net-zero carbon emissions in their investment portfolios globally by 2050.

Other highlighted measures include:

- WPP Global Growth Fund (17% of Gwynedd fund) includes Baillie Gifford’s Paris aligned fund which disinvests from fossil fuel extractors and fossil fuel service providers, and Pzena who sold their holding in a company which contributed to 35% of carbon emissions of this particular fund.

- WPP Global Opportunities Fund (17% of Gwynedd fund) has implemented a ‘decarbonisation overlay’ by Russell Investments which reduces the carbon footprint by 25%.

- ESG GRESB Benchmark – Fund has a 10% allocation to property investments and property managers, USB and Black Rock have kept their first and second position in their peer group for their environmental, social and governmental factors.

- Manager engagement – Fund engages with managers, e.g. on their voting records, to influence change at the companies the fund invests in.

A spokesman on behalf of the Gwynedd Pension Fund said: “The Gwynedd Pension Fund plan appropriately, take real action, and influence in many ways for the benefit of our environment.

“Decisions to invest or not in a particular company or type of asset will be based on the ability to generate sustainable long term returns for the fund, and this will be influenced by the approach a company takes to climate change.

“Gwynedd’s Pensions Committee are aware of the potential risks and are seeking to ensure that the Fund is invested in companies which are diversifying their businesses towards renewable sources of energy, so that they are less exposed to oil and gas in future. e.g.in the Wales Pension Partnership’s Global Opportunities decarbonisation strategy, the Fund already excludes thermal coal producers based on stranded asset risk.”

They added: “As active long-term asset owners Gwynedd Pension Fund believes that engagement is more effective tool divestment, and we regularly challenge our asset managers on their progress on environmental, social and governance issues.

“Divestment from fossil fuels needs to be considered in the round as part of an overall strategy to reduce carbon emissions across all sectors.

“As an individual pension fund and nationally as part of the Wales Pension Partnership (WPP) we have a common goal of investing locally, and nationally in Wales in renewable projects.

“We are considering investing in renewable and community projects across Wales, subject to satisfactory due diligence.”

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.