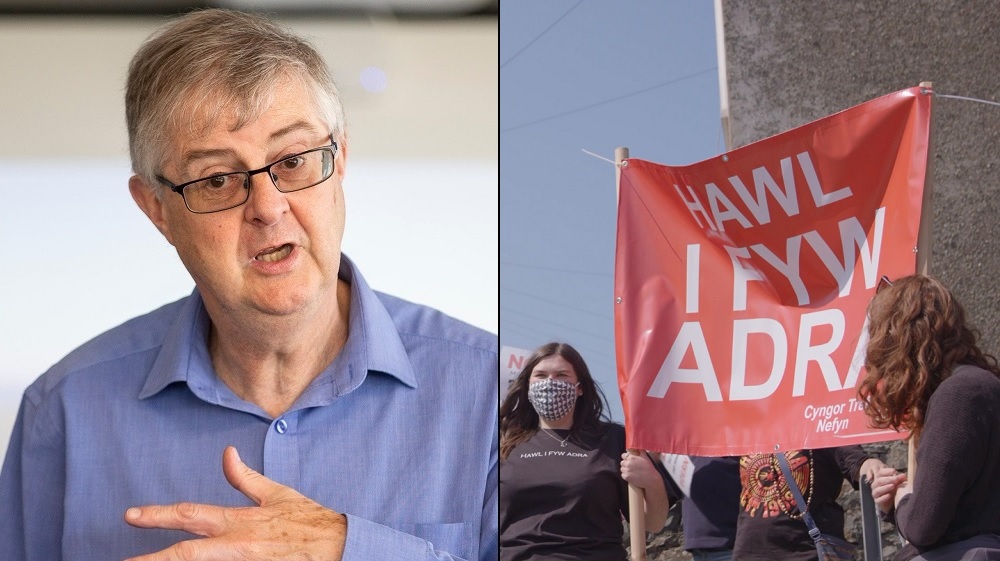

No ‘single bullet solution’ to housing crisis in north and west Wales says Drakeford

Jez Hemming, local democracy reporter

The First Minister claims there is no “single bullet solution” for the housing buying crisis gripping the north and west of Wales but new measures are in the pipeline.

Speaking on a visit to the region Mark Drakeford said a scheme helping people buy new-build properties had hit the spot – but accepted buying older properties in their localities was becoming a major problem for many.

He promised a package of measures to try and sort the mess out as locals increasingly lose out on homes to people from the major cities in the Midlands and north-west of England.

Many houses are being sold within a day, some for way above the asking price, as the exodus from city life gathers pace. It’s leaving local residents in many towns outbid and frustrated.

Mr Drakeford said working with partners on a range of measures was the key to arresting the situation.

He said: “We are going to bring forward some proposals, aimed particularly in those communities where young people are unable to stay – where young people aren’t able to find anywhere to live and stay and work in the community in which they grew up in.

“That will be a mixture of measures. It will be some measures to do with the way we tax property sales, there’ll be measures to do with planning – rights local authorities will be able to use.

“There will be things we can use to do with Land Transaction arrangements. None of these by themselves are a single bullet solution but if we bring together a range of measures we can use, then we can make a difference in those local housing markets.”

Loan

Land Transaction Tax (LTT) is the Welsh equivalent of Stamp Duty, which is paid in England.

For sales completed up to June 30 you can purchase a property costing up to £250,000 without paying LTT, after Welsh Government scrapped the bottom rate of 3.5% for purchases above £180,000.

Any portion above the sale price above £250,000 attracts a 5% charge, above £400,000 it’s 7.5% and above £750,000 it’s 10% – with the top rate (above £1.5m) attracting a 12.5% charge.

For transactions completed from July 1 you’ll pay 3.5% LTT on anything between £180,000-£250,000 in addition, which some experts believe has contributed to the rush to buy in North Wales before those changes come in.

Welsh Government’s Help to Buy scheme has aided local people in buying new-build properties up to £250,000, as long as they have a 5% deposit.

The Government then provides a shared equity loan of up to 20%, to help fund the purchase.

That loan needs to be repaid within 25 years but can be paid back in full or in part at any point within that timescale.

Support our Nation today

For the price of a cup of coffee a month you can help us create an independent, not-for-profit, national news service for the people of Wales, by the people of Wales.

10 years too late mate

Too little, far too late. Prevarication, dissembling, is this all we can expect?

Gweld hwyr na hwyrach.?

Gobeithio…

Perhaps one day Labour will walk the walk.

Building more houses isnt the answer. The younger population need infrastructure. Jobs in Wales that provide a good wage all year round, not just at tourist seasons.